The internet has revolutionized the world, transforming various aspects of daily life, including the banking sector. Online banking has made it possible for customers to complete tasks like money transfers and cash withdrawals without visiting physical bank branches. Despite the rise of digital banking, a cancelled cheque remains an important paper-based tool in certain situations. Below are some scenarios where a cancelled cheque is still essential.

What is a Cancelled Cheque?

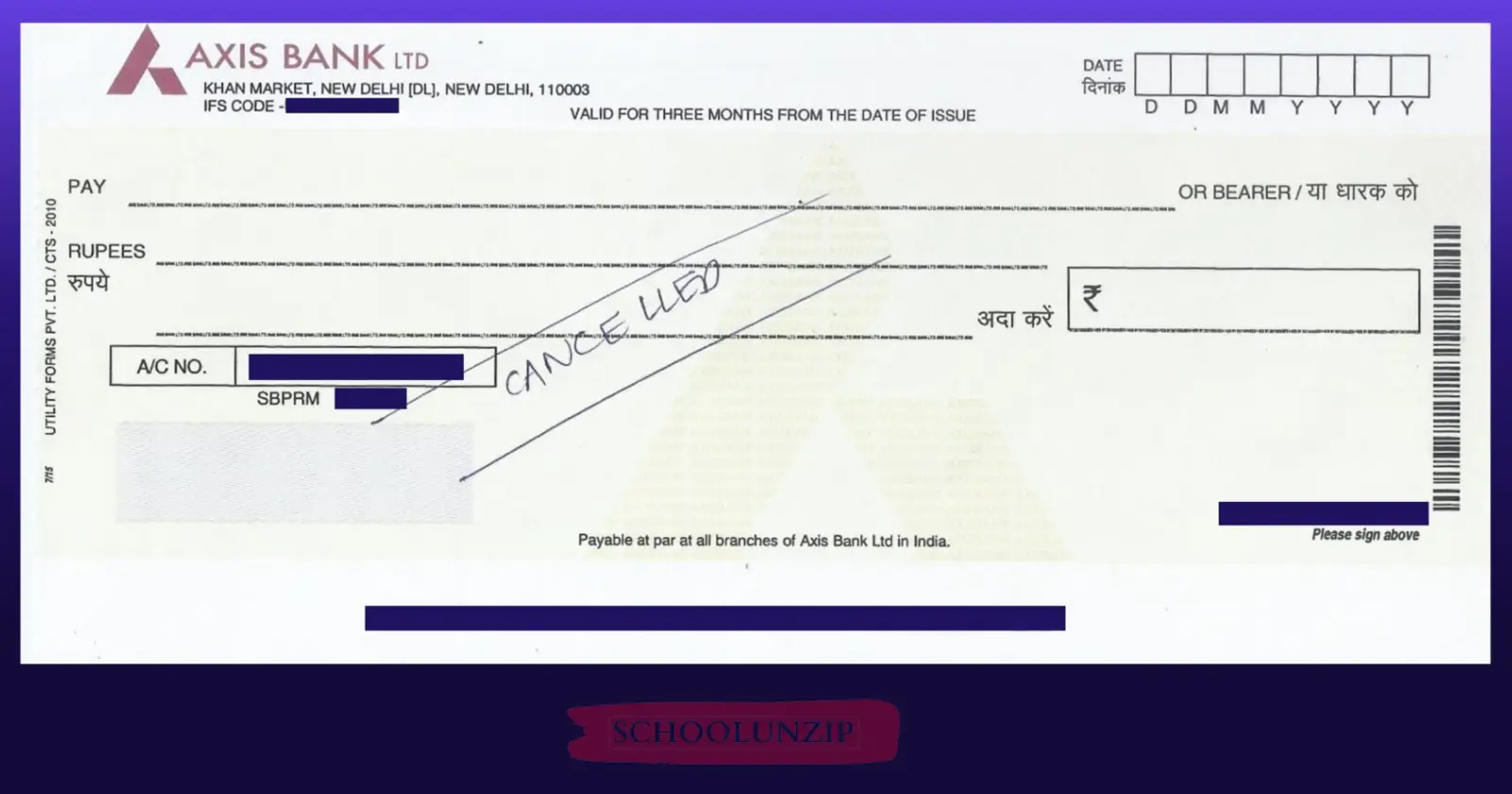

A cancelled cheque is a financial document marked with the word “CANCELLED” across it and two crossed lines. Its main purpose is to prevent any misuse while serving as an important proof of a bank account. Cancelling a cheque is crucial to protect your financial transactions.

Though simple, a cancelled cheque contains essential information like the account holder’s name, account number, MICR code, IFSC code, branch details, and cheque number. While it can’t be used to withdraw money, it plays a key role in verifying bank details, KYC procedures, and other financial transactions.

When Is It Necessary to Submit a Canceled Check?

Knowing when to provide a cancelled cheque is important as it plays a role in several financial processes. Here are some situations where a cancelled cheque is commonly needed:

=> Setting Up Electronic Fund Transfers

When arranging Electronic Fund Transfers (EFT) to receive payments like salaries or other deposits, a cancelled cheque is often required. Employers or financial institutions ask for it to verify your bank account details and ensure smooth transactions.

=> Applying for Loans

When applying for loans, banks or lending institutions may request a cancelled cheque as part of the documentation. This is to confirm your bank account information and to link the loan with your account for easier repayment or disbursement of the loan amount.

=> Opening Investment Accounts

If you are opening a new DEMAT account or making any investment, a cancelled cheque might be required to verify your bank account details. It ensures that the institution has accurate information to facilitate any future transactions like dividend payments, withdrawals, or refunds.

=> Carrying Out KYC Verification

During Know Your Customer (KYC) verification, a cancelled cheque may be requested. It helps in confirming your banking details and identity, ensuring compliance with legal and regulatory standards.

In all these situations, the cancelled cheque acts as a tool to verify and safeguard your banking details, protecting both you and the institutions involved.

How to Write a Cancelled Cheque: A Simple Guide

Writing a cancelled cheque is easy and requires only a few simple steps. Here’s how to do it:

1. Choose the Right Cheque Leaf

Pick a cheque leaf from your cheque book. It’s best to use the first unused one, but any cheque that hasn’t been used for a transaction works fine.

2. Draw Two Horizontal Lines

Use a pen with permanent ink to draw two bold horizontal lines across the cheque. These lines should go from one side of the cheque to the other to show that the cheque is cancelled.

3. Write ‘CANCELLED’ Clearly

In the middle of the cheque, write ‘CANCELLED’ in bold, capital letters. Make sure it’s clear and visible between the two lines. This makes it impossible for anyone to alter or misuse the cheque.

4. Add Extra Security (Optional)

For added security, you can write ‘For Electronic Clearing Only’ or stamp ‘VOID’ on the cheque. These extra steps help make sure the cheque cannot be used for anything else.

5. Sign the Cheque

Lastly, sign the cheque as you would normally at the bottom. Your signature confirms that the cancellation is authorized by you.

By following these steps, you will ensure that your cheque is safely cancelled and can’t be misused.

What to Do If a Cancelled Cheque Is Lost or Misplaced

Losing a cancelled cheque can be concerning, but it’s important to act quickly:

Contact Your Bank: Notify your bank immediately about the lost cheque. They will help you take the necessary precautions to protect your account from misuse.

Keep an Eye on Your Account: Routinely review your bank statements to spot any suspicious transactions. If you spot anything suspicious, report it to your bank immediately to prevent further issues.

Taking these steps will help safeguard your account and ensure your financial security. Always stay vigilant and proactive when handling important documents like cancelled cheques.

Tips to Prevent Fraud or Misuse When Cancelling a Cheque

Protecting your financial information is essential when canceling a cheque. Follow these steps to reduce the risk of fraud or misuse:

1. Use Dark Ink

Always write “CANCELLED” in bold, dark ink to prevent tampering or alterations. Avoid using pencils or light-colored pens.

2. Mark the Cheque Clearly

Draw diagonal lines, an “X,” or multiple cross marks to ensure the cheque cannot be used for transactions. Cover most of the cheque while keeping important details visible.

3. Keep Key Information Readable

Ensure essential details like your name, account number, IFSC code, and bank branch remain visible. These details are required for verification.

4. Store Cancelled Cheques Securely

Keep cancelled cheques in a safe place until they are no longer needed. Avoid leaving them unattended or disposing of them carelessly.

5. Destroy Unused or Unnecessary Cheques

If you have old or unused cheques, shred or destroy them to prevent unauthorized access and misuse.

6. Keep Records for Future Reference

Maintain a record of cancelled cheques, noting the date and purpose, to resolve any disputes if needed.

7. Stay Informed About Banking Security

Regularly update yourself on banking security measures and fraud prevention tips to protect your financial transactions.

By following these precautions, you can cancel cheques safely while minimizing any risk of fraud or unauthorized use.

Summing it Up

A cancelled cheque is a simple yet important financial document. It helps verify bank details for various transactions while ensuring security. Handling it carefully, using dark ink, and keeping records can prevent misuse. Staying cautious and informed about banking security protects your finances. A little attention goes a long way in safeguarding your account from fraud or unauthorized use. Always store your cancelled cheques securely to avoid any risks.